|

|

|

฿alance . Send Bitcoin . My Address Price . new

Bitcoin Bitcoins are created as a reward for payment processing work in which users offer their computing power to verify and record payments into the public ledger. This activity is called mining and is rewarded by transaction fees and newly created bitcoins. Bitcoin as a form of payment for products and services has grown, have warned that bitcoin users are not protected by refund rights or chargebacks. The use of bitcoin by criminals has attracted the attention of financial regulators, Contents

DesignBlock chain

The block chain is a public ledger that records bitcoin transactions. A novel solution accomplishes this without any trusted central authority: maintenance of the block chain is performed by a network of communicating nodes running bitcoin software. UnitsThe unit of account of the bitcoin system is bitcoin. As of 2014 One microbitcoin equals to 0.000001 bitcoin, which is one millionth of bitcoin. A microbitcoin is sometimes referred to as a bit. On 7 October 2014, the Bitcoin Foundation revealed a plan to apply for an ISO 4217 currency code for bitcoin, Ownership

Simplified chain of ownership. In reality, a transaction can have more than one input and more than one output.

Ownership of bitcoins implies that a user can spend bitcoins associated with a specific address. To do so, a payer must digitally sign the transaction using the corresponding private key. Without knowledge of the private key the transaction cannot be signed and bitcoins cannot be spent. The network verifies the signature using the public key. TransactionsSee also: Bitcoin network

A transaction must have one or more inputs. For the transaction to be valid, every input must be an unspent output of a previous transaction. Every input must be digitally signed. The use of multiple inputs corresponds to the use of multiple coins in a cash transaction. A transaction can also have multiple outputs, allowing one to make multiple payments in one go. A transaction output can be specified as an arbitrary multiple of satoshi. Similarly as in a cash transaction, the sum of inputs (coins used to pay) can exceed the intended sum of payments. In such case, an additional output is used, returning the change back to the payer. Any input satoshis not accounted for in the transaction outputs become the transaction fee. To send money to a bitcoin address, users can click links on webpages; this is accomplished with a provisional bitcoin URI scheme using a template registered with IANA. Bitcoin clients like Electrum and Armory support bitcoin URIs. Mobile clients recognize bitcoin URIs in QR codes, so that the user does not have to type the bitcoin address and amount in manually. The QR code is generated from the user input based on the payment amount. The QR code is displayed on the mobile device screen and can be scanned by a second mobile device. Mining

Relative mining difficulty from 2009-01-09 to 2014-12-31 (the difficulty scale is logarithmic). Relative mining difficulty is defined as the ratio between the difficulty target on 9 January 2009 and the current difficulty target.

ASICMiner Block Erupter, a type of mining hardware used in 2013.

Mining is a record-keeping service. In order to be accepted by the rest of the network, a new block must contain a so-called proof-of-work. The proof-of-work requires miners to find a number called a nonce, such that when the block content is hashed along with the nonce, the result is numerically smaller than the network's difficulty target.) before meeting the difficulty target. Every 2016 blocks (approximately 14 days), the difficulty target is adjusted based on the network's recent performance, with the aim of keeping the average time between new blocks at ten minutes. In this way the system automatically adapts to the total amount of mining power on the network. The proof-of-work system, alongside the chaining of blocks, makes modifications of the block chain extremely hard as an attacker must modify all subsequent blocks in order for the modifications of one block to be accepted. As new blocks are mined all the time, the difficulty of modifying a block increases as time passes and the number of subsequent blocks (also called confirmations of the given block) increases. PracticalitiesIt has become common for miners to join organized mining pools, The rewards of mining have led to ever-more-specialized technology being utilized. The most efficient mining hardware makes use of custom designed application-specific integrated circuits, which outperform general purpose CPUs while using less power. As of 2015, even if all miners used energy efficient processes, the combined electricity consumption would be 1.46 terawatt-hours per year—equal to the consumption of about 135,000 American homes. Supply

Total bitcoins in circulation. Horizontal axis: date ranging from 2009-01-09 to 2014-12-31.

The successful miner finding the new block is rewarded with newly created bitcoins and transaction fees. Transaction feesPaying a transaction fee is optional, but may speed up confirmation of the transaction. WalletsSee also: Digital wallet and Armory (software)

Electrum bitcoin wallet

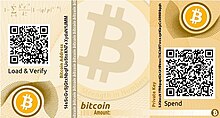

Bitcoin paper wallet generated at bitaddress.org

Trezor hardware wallet

A wallet stores the information necessary to transact bitcoins. While wallets are often described as a place to hold At its most basic, a wallet is a collection of these keys. There are several types of wallet. Software wallets connect to the network and allow spending bitcoins in addition to holding the credentials that prove ownership. Reference implementationThe first wallet program was released in 2009 by Satoshi Nakamoto as open-source code and was originally called bitcoind. PrivacyPrivacy is achieved by not identifying owners of bitcoin addresses while making other transaction data public. Bitcoin users are not identified by name, but transactions can be linked to individuals and companies. FungibilityWallets and similar software technically handle bitcoins as equivalent, establishing the basic level of fungibility. Researchers have pointed out that the history of every single bitcoin is registered and publicly available in the block chain ledger, and that some users may refuse to accept bitcoins coming from controversial transactions, which would harm bitcoin's fungibility. HistoryMain article: History of bitcoin

Number of bitcoin transactions per month (logarithmic scale)

Bitcoin was invented by Satoshi Nakamoto, One of the first supporters, adopters, contributor to bitcoin and receiver of the first bitcoin transaction was programmer Hal Finney. Finney downloaded the bitcoin software the day it was released, and received 10 bitcoins from Nakamoto in the world's first bitcoin transaction. Other early supporters were Wei Dai, creator of bitcoin predecessor b-money, and Nick Szabo, creator of bitcoin predecessor bit gold. In 2010, an exploit in an early bitcoin client was found that allowed large numbers of bitcoins to be created. Based on bitcoin's open source code, other cryptocurrencies started to emerge in 2011. In March 2013, a technical glitch caused a fork in the block chain, with one half of the network adding blocks to one version of the chain and the other half adding to another. For six hours two bitcoin networks operated at the same time, each with its own version of the transaction history. The core developers called for a temporary halt to transactions, sparking a sharp sell-off. In 2013 some mainstream websites began accepting bitcoins. WordPress had started in November 2012,) In May 2013, the Department of Homeland Security seized assets belonging to the Mt. Gox exchange. In October 2013, Chinese internet giant Baidu had allowed clients of website security services to pay with bitcoins. The first bitcoin ATM was installed in October 2013 in Vancouver, British Columbia, Canada. With about 12 million existing bitcoins in November 2013, In the US two men were arrested in January 2014 on charges of money-laundering using bitcoins; one was Charlie Shrem, the head of now defunct bitcoin exchange BitInstant and a vice chairman of the Bitcoin Foundation. Shrem allegedly allowed the other arrested party to purchase large quantities of bitcoins for use on black-market websites. In early February 2014, one of the largest bitcoin exchanges, Mt. Gox, On June 18, 2014, it was announced that bitcoin payment service provider BitPay would become the new sponsor of St. Petersburg Bowl under a two-year deal, renamed the Bitcoin St. Petersburg Bowl. Bitcoin was to be accepted for ticket and concession sales at the game as part of the sponsorship, and the sponsorship itself was also paid for using bitcoin. Less than one year after the collapse of Mt. Gox, Bitstamp announced that the exchange would be taken offline while they investigate a hack which resulted in about 19,000 bitcoins (equivalent to roughly US$5 million at that time) being stolen from their hot wallet. The bitcoin exchange service Coinbase launched the first regulated bitcoin exchange in 25 US states on January 26, 2015. At the time of the announcement, CEO Brian Armstrong stated that Coinbase intends to expand to thirty countries by the end of 2015. EconomicsClassificationAccording to the director of the Institute for Money, Technology and Financial Inclusion at the University of California-Irvine there is "an unsettled debate about whether bitcoin is a currency". Economists define money as a store of value, a medium of exchange, and a unit of account and agree that bitcoin has some way to go to meet all these criteria. Journalists and academics also dispute what to call bitcoin. Some media outlets do make a distinction between "real" money and bitcoins, The People's Bank of China has stated that bitcoin "is fundamentally not a currency but an investment target". Buying and sellingBitcoins can be bought and sold both on- and offline. Participants in online exchanges offer bitcoin buy and sell bids. Using an online exchange to obtain bitcoins entails some risk, and, according to a study published in April 2013, 45% of exchanges fail and take client bitcoins with them. Price and volatility

Price Left vertical axis: price, the scale is logarithmic. Right vertical axis: volatility. Horizontal axis: date ranging from 2010-08-17 to 2014-12-31.

To improve access to price information and increase transparency, on 30 April 2014 Bloomberg LP announced plans to list prices from bitcoin companies Kraken and Coinbase on its 320,000 subscription financial data terminals. According to Mark T. Williams, as of 2014 Attempting to explain the high volatility, a group of Japanese scholars stated that there is no stabilization mechanism. There are uses where volatility does not matter, such as online gambling, tipping, and international remittances. The price of bitcoins has gone through various cycles of appreciation and depreciation referred to by some as bubbles and busts. Speculative bubble disputeBitcoin has been labelled a speculative bubble by many including former Fed Chairman Alan Greenspan Ponzi scheme disputeVarious journalists, U.S. economist Nouriel Roubini, former senior adviser to the U.S. Treasury and the International Monetary Fund, has stated that bitcoin is "a Ponzi game". Others have expressed the opinion that bitcoin is not a Ponzi scheme. The Huffington Post asked, "is bitcoin a Ponzi scheme, yes or no?" answering the question with a definitive "no!". Value forecastsFinancial journalists and analysts, economists, and investors have attempted to predict the possible future value of bitcoin. In April 2013, economist John Quiggin stated, "bitcoins will attain their true value of zero sooner or later, but it is impossible to say when". Bitcoin obituariesThe "death" of bitcoin has been proclaimed numerous times. ReceptionSome economists have responded positively to bitcoin, but many have not. François R. Velde, Senior Economist at the Chicago Fed described it as "an elegant solution to the problem of creating a digital currency". David Andolfatto, Vice President at the Federal Reserve Bank of St. Louis, stated that bitcoin is a threat to the establishment, which he argues is a good thing for the Federal Reserve System and other central banks because it prompts these institutions to operate sound policies. Free software movement activist Richard Stallman has criticized the lack of anonymity and called for reformed development. Similarly, Peter Schiff, a bitcoin sceptic understands "the value of the technology as a payment platform" and his Euro Pacific Precious Metals fund partnered with BitPay in May 2014, because "a wire transfer of fiat funds can be slow and expensive for the customer". Kevin Dowd, Professor of Finance and economics at Durham University has a bearish outlook on bitcoin. His presentation at the Cato Institute 2014 Annual Conference, Alternatives to Central Banking: Toward Free-Market Money, touched on bitcoin. Acceptance by merchants

Bitcoins are accepted in this café in the Netherlands as of 2013

In 2015, the number of merchants accepting bitcoin exceeded 100,000. As of September 2014 PayPal allows North American merchants using its system the ability to receive payment in bitcoins. Organizations accepting donations in bitcoin include: Greenpeace, Mainstream use of bitcoinAs of February 2015 Financial institutionsBitcoin companies have had difficulty opening traditional bank accounts because lenders have been leery of bitcoin's links to illicit activity. One financial institution has been bullish on bitcoin. In a 2013 report, Bank of America Merrill Lynch stated that "we believe bitcoin can become a major means of payment for e-commerce and may emerge as a serious competitor to traditional money-transfer providers." As investmentSome Argentinians have bought bitcoins to protect their savings against high inflation or the possibility that governments could confiscate savings accounts. In 2013 and 2014, the European Banking Authority In May 2015, Intercontinental Exchange Inc., parent company of the New York Stock Exchange, announced a bitcoin index initially based on data from Coinbase transactions. Venture capitalVenture capitalists, such as Peter Thiel's Founders Fund, which invested US$3 million in BitPay, do not purchase bitcoins themselves, instead funding bitcoin infrastructure like companies that provide payment systems to merchants, exchanges, wallet services, etc. Political economyBitcoin appeals to tech-savvy libertarians, because it so far exists outside the institutional banking system and the control of governments. Bitcoin's appeal reaches from left wing critics, "who perceive the state and banking sector as representing the same elite interests, [...] recognising in it the potential for collective direct democratic governance of currency" Legal status and regulationMain article: Legality of bitcoin by country

Various government agencies, departments, and courts have treated bitcoin differently. A few governments have moved to regulate bitcoin and similar payment systems. According to the European Central Bank, traditional financial sector regulation is not applicable because bitcoin does not involve traditional financial actors. In April 2013, Steven Strauss, a Harvard public policy professor, suggested that governments could outlaw bitcoin, AustraliaAustralia classifies bitcoin as property and an asset for capital gains purposes, however capital gains or losses arising from personal use of bitcoins is disregarded providing the cost of the bitcoins was less than $10,000. ChinaWhile private parties can hold and trade bitcoins in China, regulation prohibits financial firms like banks from doing the same. European UnionThe European Central Bank classifies bitcoin as a convertible decentralized virtual currency. IcelandAs of 2014, foreign exchange activities with bitcoin are illegal in Iceland. RussiaCNBC reported that bitcoin was illegal in Russia in December, 2014, TaiwanWhile bitcoin itself is not illegal here, bitcoin ATMs are prohibited. ThailandIn 2013, the Thai monetary authority, the Bank of Thailand, "issued a preliminary ruling that using bitcoins as described was illegal." United StatesThe U.S. Treasury classified bitcoin as a convertible decentralized virtual currency in 2013. The U.S. Government Accountability Office (GAO) recommended in May 2013, that the Internal Revenue Service (IRS) formulate a tax guidance for bitcoin businesses. In November 2013, the United States Senate held a committee hearing titled "Beyond Silk Road: Potential Risks, Threats and Promises of Virtual Currencies" to discuss virtual currencies. The Federal Election Commission (FEC) deadlocked in November 2013 on whether to allow bitcoin in political campaigns with three Democrat members voting nay, three Republicans voting yea. In May 2014, Brett Stapper, co-founder of Falcon Global Capital, registered to lobby members of Congress and federal agencies on issues related to bitcoin. In January 2014, the U.S. Securities and Exchange Commission (SEC) focused on whether bitcoin-denominated stock exchanges were illegal, and inquired into unregistered securities offerings of the gambling site SatoshiDice and FeedZeBirds. The U.S. Commodity Futures Trading Commission (CFTC) stated in March 2014 it considered regulation of digital currencies In June 2014 California Assemblyman Roger Dickinson (D–Sacramento) submitted draft legislation (Assembly Bill 129) to legalize bitcoin and other forms of alternative and digital currency. As of May 2015 VietnamVietnamese authorities have deemed bitcoin trading illegal. Criminal activityThe use of bitcoin by criminals has attracted the attention of financial regulators, legislative bodies, law enforcement, and the media. Several news outlets have asserted that the popularity of bitcoins hinges on the ability to use them to purchase illegal goods. TheftThere have been many cases of bitcoin theft. Theft also occurs at sites bitcoins are used to purchase illicit goods. In late November 2013, an estimated $100 million in bitcoins were stolen from the online illicit goods marketplace Sheep Marketplace, which immediately closed. Sites where users exchange bitcoins for cash are another target for theft. In late February 2014 Mt. Gox, one of the largest virtual currency exchanges, filed for bankruptcy in Tokyo amid reports that 744,000 bitcoins had been stolen. Black marketsA CMU researcher estimated that in 2012, 4.5% to 9% of all transactions on all exchanges in the world were for drug trades on a single deep web drugs market, Silk Road. are also available on black market sites that sell in bitcoin. Several deep web black markets have been shut by authorities. In October 2013 Silk Road was shut down by U.S. law enforcement Some black market sites may seek to steal bitcoins from customers. The bitcoin community branded one site, Sheep Marketplace, as a scam when it prevented withdrawals and shut down after an alleged bitcoins theft. According to the Internet Watch Foundation, a U.K. based charity, bitcoin is used to purchase child pornography, and almost 200 such websites accept it as payment. Bitcoin isn't the sole way to purchase child pornography online, as Troels Oertling, head of the cybercrime unit at Europol, states, "Ukash and Paysafecard... have [also] been used to pay for such material." However, the Internet Watch Foundation lists around 30 sites that exclusively accept bitcoins. Money launderingBitcoins may not be ideal for money laundering because all transactions are public. Ponzi schemeIn a Ponzi scheme that utilized bitcoins, The Bitcoin Savings and Trust promised investors up to 7 percent weekly interest, and raised at least 700,000 bitcoins from 2011 to 2012. MalwareBitcoin-related malware includes software that steals bitcoins from users using a variety of techniques, software that uses infected computers to mine bitcoins, and different types of ransomware, which disable computers or prevent files from being accessed until some payment is made. Security company Dell SecureWorks said in February 2014 that it had identified almost 150 types of bitcoin malware. Unauthorized miningIn June 2011, Symantec warned about the possibility that botnets could mine covertly for bitcoins. In mid-August 2011, bitcoin mining botnets were detected, In April 2013, electronic sports organization E-Sports Entertainment was accused of hijacking 14,000 computers to mine bitcoins; the company later settled the case with the State of New Jersey. German police arrested two people in December 2013 who customized existing botnet software to perform bitcoin mining, which police said had been used to mine at least $950,000 worth of bitcoins. For four days in December 2013 and January 2014, Yahoo! Europe hosted an ad containing bitcoin mining malware that infected an estimated two million computers. Several reports of employees or students using university or research computers to mine bitcoins have been published. Malware stealingSome malware can steal private keys for bitcoin wallets allowing the bitcoins themselves to be stolen. The most common type searches computers for cryptocurrency wallets to upload to a remote server where they can be cracked and their coins stolen. This method is effective because bitcoin transactions are irreversible. One virus, spread through the Pony botnet, was reported in February 2014 to have stolen up to $220,000 in cryptocurrencies including bitcoins from 85 wallets. A type of Mac malware active in August 2013, Bitvanity posed as a vanity wallet address generator and stole addresses and private keys from other bitcoin client software. RansomwareAnother type of bitcoin-related malware is ransomware. One program called CryptoLocker, typically spread through legitimate-looking email attachments, encrypts the hard drive of an infected computer, then displays a countdown timer and demands a ransom, usually two bitcoins, to decrypt it. SecurityVarious potential attacks on the bitcoin network and its use as a payment system, real or theoretical, have been considered. The bitcoin protocol includes several features that protect it against some of those attacks, such as unauthorized spending, double spending, forging bitcoins, and tampering with the block chain. Other attacks, such as theft of private keys, require due care by users. Unauthorized spendingUnauthorized spending is mitigated by bitcoin's implementation of public-private key cryptography. When Alice sends a bitcoin to Bob, Bob becomes the new owner of the bitcoin. Eve observing the transaction might want to spend the bitcoin Bob just received, but she cannot sign the transaction without the knowledge of Bob's private key. Double spendingA specific problem that an internet payment system must solve is double-spending, whereby a user pays the same coin to two or more different recipients. An example of such a problem would be if Eve sent a bitcoin to Alice and later sent the same bitcoin to Bob. The bitcoin network guards against double-spending by recording all bitcoin transfers in a ledger (the block chain) that is visible to all users, and ensuring for all transferred bitcoins that they haven't been previously spent. Race attackIf Eve offers to pay Alice a bitcoin in exchange for goods and signs a corresponding transaction, it is still possible that she also creates a different transaction at the same time sending the same bitcoin to Bob. By the rules, the network accepts only one of the transactions. This is called race attack, since there is a race which transaction will be accepted first. Alice can reduce the risk of race attack stipulating that she will not deliver the goods until Eve's payment to Alice appears in the block chain. A variant race attack (which has been called a Finney attack by reference to Hal Finney) requires the participation of a miner. Instead of sending both payment requests (to pay Bob and Alice with the same coins) to the network, Eve issues only Alice's payment request to the network, while the accomplice tries to mine a block that includes the payment to Bob instead of Alice. There is a positive probability that the rogue miner will succeed before the network, in which case the payment to Alice will be rejected. As with the plain double-spending attack, Alice can reduce the risk of a Finney attack by waiting for the payment to be included in the block chain. History modificationThe other principal way to steal bitcoins would be to modify block chain ledger entries. For example, Eve could buy something from Alice, like a sofa, by adding a signed entry to the block chain ledger equivalent to Eve pays Alice 100 bitcoins. Later, after receiving the sofa, Eve could modify that block chain ledger entry to read instead: Eve pays Alice 1 bitcoin, or replace Alice's address by another of Eve's addresses. Digital signatures cannot prevent this attack: Eve can simply sign her entry again after modifying it. To prevent modification attacks, each block of transactions that is added to the block chain includes a cryptographic hash code that is computed from the hash of the previous block as well as all the information in the block itself. When the bitcoin software notices two competing block chains, it will automatically assume that the chain with the greatest amount of work to produce it is the valid one. Therefore, in order to modify an already recorded transaction (as in the above example), the attacker would have to recalculate not just the modified block, but all the blocks after the modified one, until the modified chain contains more work than the legitimate chain that the rest of the network has been building in the meantime. Consequently, for this attack to succeed, the attacker must outperform the honest part of the network. Each block that is added to the block chain, starting with the block containing a given transaction, is called a confirmation of that transaction. Ideally, merchants and services that receive payment in bitcoin should wait for at least one confirmation to be distributed over the network, before assuming that the payment was done. The more confirmations that the merchant waits for, the more difficult it is for an attacker to successfully reverse the transaction in a block chain—unless the attacker controls more than half the total network power, in which case it is called a 51% attack. Selfish miningThis attack was first introduced by Ittay Eyal and Emin Gun Sirer at the beginning of November 2013. In this attack, the attacker finds blocks but does not broadcast them. Instead, the attacker mines their own private chain and eventually (when another miner or network of miners finds their own block) publishes several private blocks in a row. This forces the "honest" network to abandon their previous work and switch to the attacker's branch. As a result, honest miners lose a significant part of their revenue, while the attacker increases their profits due to changes in relative hashpowers. According to the authors, a rational miner observing a selfish mining attacker would have an incentive to join the attacker's pool, thereby increasing the attacker's hashpower. This makes the attack and incentives even stronger, thus potentially leading to a 51% attack and the collapse of the currency. Gavin Andresen and Ed Felten disagreed with this conclusion, Deanonymisation of clientsAlong with transaction graph analysis, which may reveal connections between bitcoin addresses (pseudonyms), Non-bitcoin applications of the block chainIn January 2015 IBM’s Institute for Business Value announced ADEPT (Autonomous Decentralized Peer-to-Peer Telemetry) where network-connected devices can interact autonomously on the Internet of things using freely available technology including bittorrent, Telehash, and bitcoin. In May 2015 NASDAQ announced its intention to use bitcoins of negligible value, called "colored coins", to represent and transfer pre-IPO trading shares on Nasdaq Private Markets. Block chain spamWhile it is possible to store any digital file in the block chain, the larger the transaction size the larger any associated fees become. In the mediaSeveral lighthearted songs celebrating bitcoin have been released. In Season 3 CBS show The Good Wife featured an episode alluding to the creator of bitcoin as well as the FBI investigating the case. The episode titled 'Bitcoin for Dummies' was shown in early 2012. A bitcoin documentary film called The Rise and Rise of Bitcoin was released in late 2014 and features interviews with people who use bitcoin such as a computer programmer and a drug dealer. In the fall of 2014, undergraduate students at the Massachusetts Institute of Technology (MIT) each received bitcoins worth $100 "to better understand this emerging technology". In early 2015, the CNN series Inside Man featured an episode about bitcoin. Filmed in July, 2014, it featured Morgan Spurlock living off of bitcoins for a week to figure out whether the world is ready for a new kind of money. In science fiction novel Neptune's Brood by Charles Stross a modification of bitcoin is used as the universal interstellar payment system. The functioning of the system is a major plot element of the book. ls |